10 Essential Financial Planning Tips to Master Your Wealth Growth Strategy

Honestly, the phrase "financial planning" used to make my skin crawl. It felt like a punishment rather than a liberating strategy. Whenever I thought about it, I’d picture someone wagging a finger at me, telling me to stop buying coffee, cancel my Netflix subscription, and basically stop enjoying my life just so I could potentially have money when I’m eighty. It felt restrictive, boring, and frankly, kind of depressing.

But here’s the thing I realized way later than I should have: cutting out lattes isn’t a strategy. It’s scarcity. And scarcity keeps you small.

At Jaga, we look at finance differently. Think of yourself less like a scrimper and more like the CEO of your own household. A good CEO doesn’t slash the budget just to survive; they allocate capital to make the business grow. If you want to move from that chaotic feeling of "where did it all go?" to actually growing your capital, you need a framework that prioritizes expansion, not just restriction. By shifting your perspective, you transform money from a source of stress into a tool for empowerment.

This isn’t a list of quick hacks or "get rich quick" nonsense. This is the 10-step growth framework that high-net-worth individuals use to actually secure their future (and sleep better at night). It is about comprehensive wealth management that aligns your money with your life.

Where Do You Stand Right Now?

I’ll admit, most of us lie to ourselves about money. We think we’re doing "okay" because the bills are paid, but we rarely look under the hood to see the true state of our financial health. Don’t guess. Before you begin, review the Financial Growth Maturity Model and score your current strategy against the 10 pillars. This will help you identify exactly where your plan is leaking capital and which areas need immediate attention.

Phase 1: The Foundation (Audit & Vision)

You cannot build a skyscraper on a swamp. I tried to do this once—investing before I had my basics down—and it was a disaster. Before we talk about sexy things like investing or tax loopholes, we must stabilize the ground beneath you.

1. Architect Your Financial "North Star" (Goal Setting)

"I want to be rich" isn't a plan. It's a wish. And vague desires lead to vague results (and usually, disappointment). To build a growth strategy, you have to get specific, which can be annoying, but it's necessary. You must quantify your finish line and establish clear financial goals. Without a clear destination, you cannot map the route.

We categorize these goals into three distinct time horizons to provide clarity and structure:

Liquidity Needs (0–2 Years): This is cash required for upcoming major purchases, such as a home down payment, a wedding, or a new car. This money should never be exposed to volatility, as short-term fluctuations can derail your plans. If the market dips 20% right before you need to sign a check, your entire timeline is compromised.

Growth Targets (3–10 Years): This represents the capital needed for expansion, such as starting a business or purchasing rental property. This is where you begin accumulating assets in earnest. This horizon allows for some risk, balancing growth potential with the need for capital preservation as the target date approaches.

Legacy Goals (10+ Years): This is the number you need to hit to make work optional, often referred to as Financial Independence or long-term retirement planning.

The Action:

Reverse-engineer the math. If you need a $2M portfolio to generate $80,000/year in passive income, you now have a target to measure every decision against.

The Jaga Growth Rationale: Strategy follows vision. We do not invest a single dollar until we know exactly what "job" that dollar is hired to do. If the goal is 12 months away, the money stays in cash. If it’s 20 years away, it goes into equities. The goal dictates the vehicle.

2. Establish Your Baseline: The Net Worth Statement

Income is vanity; net worth is sanity. That’s a tough pill to swallow. Your income measures your effort, but your Net Worth measures your financial results. We often see high-income earners who are "asset poor"—a phenomenon known as HENRYs (High Earners, Not Rich Yet). They make a lot, but they keep nothing, preventing true wealth accumulation. They are running on a treadmill, earning high salaries but never actually moving forward financially.

To fix this, you must track your true score using this formula:

$$Assets (What You Own) - Liabilities (What You Owe) = Net Worth$$

The Action: Stop obsessing over your checking account balance. Track your Net Worth quarterly. If this number is not trending upward, your financial plan is broken, regardless of your salary.

The Jaga Growth Rationale: You cannot improve what you do not measure. This statement is your brutal truth. It tells us if you are actually building wealth or just financing a lifestyle. It separates the appearance of wealth from the reality of it.

3. Design a "Profit-First" Cash Flow System

I used to use those budgeting apps that yell at you when you overspend on tacos. It felt like a cage. We prefer Capital Allocation. This shifts the mindset from "limiting spending" to "directing resources". It’s about permission, not restriction. It’s about taking control of your finance and directing it where it serves you best.

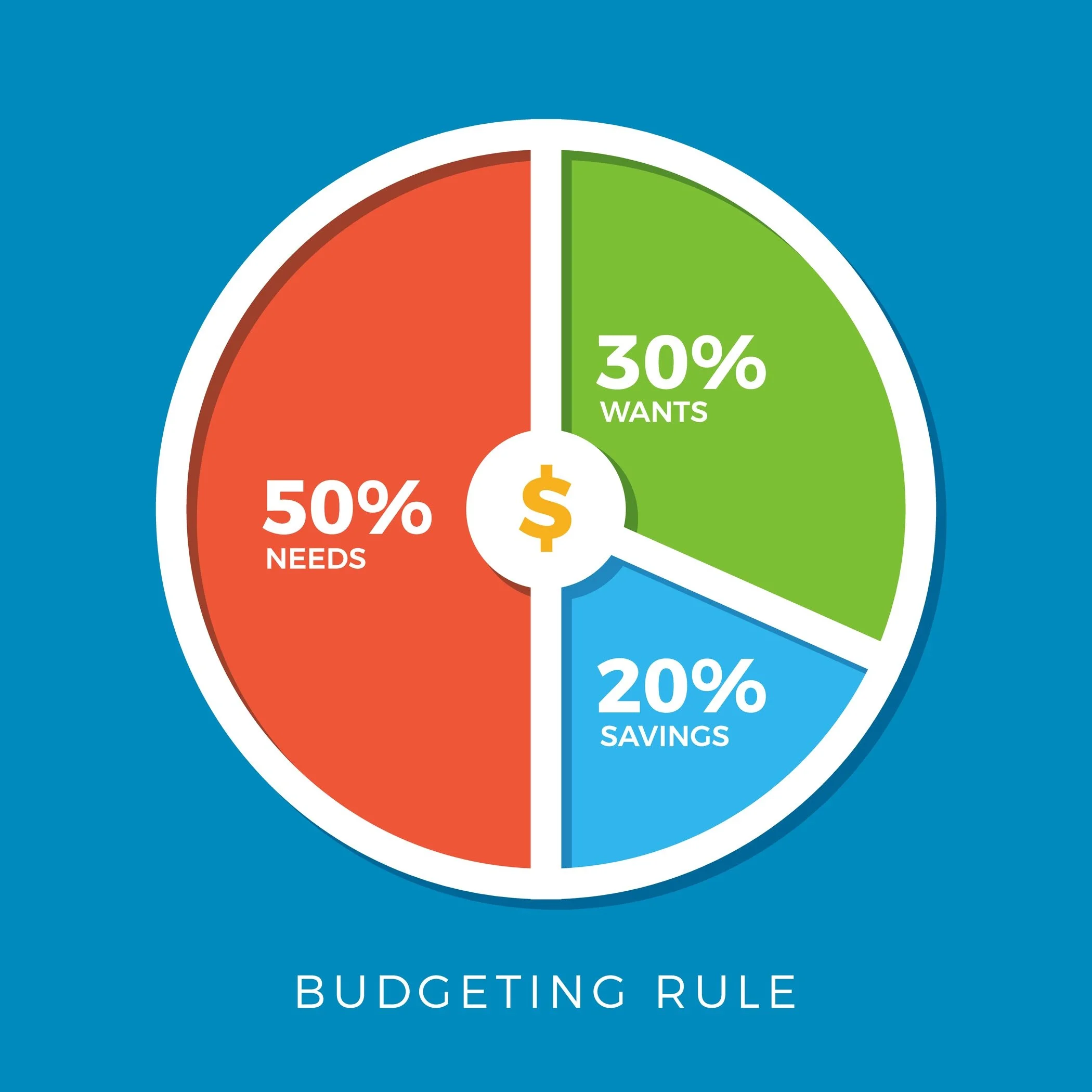

Use the 50/30/20 Protocol as your baseline for allocation:

50% Needs: Use this for essential expenses like housing, food, and utilities.

30% Wants: This covers lifestyle choices, travel, and dining—enjoying your wealth along the way.

20% Capital Deployment: This is not just savings2. This is money deployed to debt, investments, and assets. You must save this portion aggressively.

The Action

Automate your capital deployment. Set your transfers to occur on payday, before you see the money. If you wait to save what’s left over, there will be nothing left4. Human nature will always find a way to spend available cash; automation removes the temptation.

The Jaga Growth Rationale

You cannot out-invest a bleeding cash flow. We view your monthly surplus as "investable capital". The larger the surplus, the faster the growth. A budget is simply a tool to maximize that surplus and ensure your financial goals are met.

Found Leaks in Your Cash Flow?

It’s usually right under your nose. Most clients are losing $500–$1,000 monthly to inefficiencies. [Book a 15-Minute Cash Flow Audit] with us. We’ll help you find that capital so you can redeploy it into your financial future.

Phase 2: The Shield (Risk Management)

I remember when my car transmission blew up the same month I had a massive vet bill. Without a shield, that would have derailed everything. Once you have capital, you must protect it. One unexpected event should not be able to wipe out a decade of progress.

4. Construct Your Financial Moat (Emergency Fund)

An emergency fund isn't an "investment" that needs to earn big returns. It's peace of mind. It is insurance against having to liquidate your assets at the wrong time. If the economy crashes and you lose your job simultaneously, this cash allows you to survive without selling your stocks at a 40% loss. Without a fully funded emergency fund in place, you remain vulnerable to life's inevitable curveballs. You need to save specifically for this purpose before taking on higher risk.

The Action

Dual-Income Households: Keep 3 months of expenses in a High-Yield Savings Account (HYSA).

Entrepreneurs/Single-Income: Keep 6 months in a HYSA to account for variable income.

The Jaga Growth Rationale

Volatility is the price of admission for high investment returns. Your cash moat buys you the patience to wait out economic downturns without panic-selling. It is the foundation of your risk tolerance.

5. Eliminate Wealth Anchors (Toxic Debt)

Debt feels heavy. Physically heavy. But not all debt is bad. A 3% mortgage is leverage. A 22% credit card is an anchor dragging you to the bottom of the ocean. To accelerate wealth creation, you must cut the anchors.

The Action

The Mathematical Guillotine (Avalanche Method): Attack the debt with the highest interest rate first. This is one of the most efficient mathematical strategies.

The Psychological Win (Snowball Method): Pay off the smallest balance first to build momentum.

The Jaga Growth Rationale

Paying off a 20% credit card is the mathematical equivalent of earning a guaranteed 20% return on investment (ROI). No hedge fund manager in the world can promise you that guaranteed return. Clear the deck before you try to get fancy with investing.

6. Insure the Asset (You)

We all think we’re invincible. I definitely did. But your ability to earn an income is likely a multi-million dollar asset. If you are 35 and earning $100k/year, you are a "money machine" worth $3M+ over the next 30 years. You insure your car; why wouldn't you buy insurance for the machine that pays for the car? Proper insurance coverage is a non-negotiable part of risk management.

The Action

Disability Insurance: Statistically, you are far more likely to be disabled than die young. Ensure you have "Own Occupation" coverage to protect your earnings.

Term Life Insurance: If anyone relies on your income, you need 10-12x your income in Term Life coverage. Avoid expensive "Whole Life" products unless you have a highly specific estate tax need.

The Jaga Growth Rationale

A growth strategy collapses if the primary earner goes offline. insurance is defensive; it transfers catastrophic consequences away from your portfolio so your compounding isn't interrupted by life’s tragedies.

Phase 3: The Expansion (Wealth Acceleration)

With a strong foundation and a secure shield, we now press the accelerator. This is where it gets fun.

7. Execute the "Time in Market" Strategy

Patience is the hardest part of this whole thing. Compound interest is the eighth wonder of the world, but its fuel is time. The biggest danger to your portfolio is not being in the market because you're waiting for the "perfect moment". You must start early to let compounding work its magic on your wealth. Every day you sit on the sidelines is a day your money isn't working for you.

The Action

Asset Location: Put high-growth investment assets (stocks) in tax-free accounts (Roth IRA) and slower-growth assets (bonds) in tax-deferred accounts.

Diversification: Stop trying to pick the next "hot stock". Use Index Funds and ETFs to own the entire market and capture broad financial growth.

The Jaga Growth Rationale

We don't speculate; we allocate. The goal isn't to beat the market every week; it's to remain in the market for decades. Time in the market always beats timing the market.

8. Implement Tax-Efficiency Protocols

It hurts to look at a pay stub and see how much disappears before it even hits your bank. It’s not what you make; it’s what you keep. Tax expenses are the single largest fee you will pay in your lifetime. A 1% savings in tax planning efficiency is worth more than a 1% increase in returns.

The Action: Order of Operations

Employer Match: This provides a 100% return on your money immediately—free wealth.

HSA: This account offers a triple tax advantage: tax deduction in, tax-free growth, and tax-free out for medical expenses.

Roth IRA: Pay taxes now, never pay them again.

Brokerage: This account is taxable, but flexible.

The Jaga Growth Rationale

Tax drag kills compounding. By optimizing where you put your money, you increase your effective investment yield without taking on any additional volatility or uncertainty.

Phase 4: The Legacy (Longevity)

Thinking about the end isn't pleasant. But a true strategy looks beyond your lifetime.

9. Codify Your Legacy (Estate Planning)

Estate planning isn't just for the ultra-wealthy or the elderly. It's about control. It dictates who makes decisions when you can't, and ensures your wealth blesses your family rather than burdening them with legal fees and fighting. A proper estate plan prevents the government from deciding the fate of your assets.

The Action

Beneficiary Audit: Check your 401(k) and IRA beneficiaries immediately. These designations override your Will and are a critical part of estate planning.

The "In Case of Emergency" File: Create a secure digital or physical location with account passwords, ledgers, and healthcare directives.

The Jaga Growth Rationale

Wealth without a transfer strategy leads to family conflict and probate courts. We build estate plans that ensure your hard-earned assets go exactly where you intend them to go.

10. The Annual Strategic Pivot (Updating Your Financial Plan)

"Set it and forget it" works for a crockpot, not your life savings. A financial plan is organic. It must evolve as your career, family, and the economy change. Professional financial advisors often recommend reviewing this annually. Sometimes, you just need a dedicated financial advisor to look over your shoulder and spot blind spots you missed.

The Action

Rebalancing: Systematically selling winners (selling high) to buy underperformers (buying low) to maintain your target risk profile.

The Life Audit: Did you get married? Have a child? Change jobs? Your financial plan must pivot to reflect your new reality.

The Jaga Growth Rationale

This annual review is where the magic happens. We ensure your strategies remain aligned with your reality, preventing your portfolio from drifting into danger zones. If this feels overwhelming, consider engaging professional services to guide you.

Stop Guessing. Start Executing.

I remember staring at my own messy finances years ago, feeling a mix of shame and paralysis. It felt easier to just ignore it and hope it worked out. But hope isn't a strategy.

When you finally put a framework like this in place, the feeling is indescribable. It’s not just about the numbers in the bank account going up—though that’s nice. It’s the quiet in your head. It’s the knot in your chest loosening up because you know that no matter what happens—an economic collapse, job loss, surprise expenses—you have a financial plan for it.

You don't have to carry that weight alone anymore. Your financial future is too important to leave to a blog post or a guess. If you need help with wealth management, let’s build your custom implementation roadmap together.